Earnout Dice-Roll?? Secure Your Bet with a GM Approach

In the staffing industry, understanding the financial dynamics of a business is crucial, especially when it comes to acquisitions. One key aspect often under scrutiny is the earnout structure. But what’s the best way to approach this?

The Core of COGS:

The real costs in our industry boil down to our client-facing workforce. This includes wages, statutory obligations, and workers’ compensation. These expenses form the core of our Cost of Goods Sold (COGS). After these are paid, what remains is our gross margin. This isn’t just any figure; it’s the lifeblood of our business, powering everything we do, whether it’s temp, contract, or direct-hire placements.

Earnouts and the Complication with EBITDA:

When it comes to earnouts in staffing company acquisitions, some buyers lean towards tying them to EBITDA or Net Income. However, this approach can be fraught with complications. Post-sale, the new owner usually takes over operating expenses, and as we all know, accounting practices can vary. This variability can lead to gray areas and potential disputes when determining if the earnout target has been met.

Why Gross Margin Makes Sense:

This is where gross margin becomes a game-changer. It’s a straightforward calculation: revenue minus the direct costs associated with temp/contractor placements. Clear, unambiguous, and an ideal measure for evaluating earnout targets. It accurately reflects the true performance of the business and how efficiently all types of placements are managed. Most importantly, it’s a reliable indicator of business health, unaffected by variables that might be out of control post-sale.

Setting Fair Earnout Targets:

With this in mind, it’s advisable to set earnout targets irrespective of placement type. The target should match the gross margin amount present when the buyer conducted their valuation and made their offer. This ensures the target is fair, based on current business performance, and achievable. It’s an equitable approach, reflecting the business’s ability to sustain its gross margin post-transaction.

Provisions for Performance:

Effective earnouts should include provisions for both underachievement and overachievement of the target. It shouldn’t be an all-or-nothing scenario. Falling short means earning less, while exceeding expectations should rightly result in more. This creates a balanced, performance-based structure that’s fair for both parties.

Conclusion:

In staffing company acquisitions, focusing on gross margin for earnouts offers clarity, fairness, and a true reflection of business performance. It’s a strategy that aligns interests and promotes a healthy, sustainable business post-acquisition.

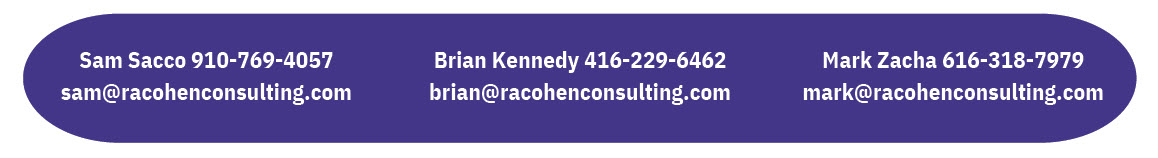

Don’t leave your M&A journey to chance. Reach out to us today.

Call us or send a message and let’s discuss how we can support your goals and ensure a successful transition for your staffing company.